Checkr: Playing Chess in the Background Screening Industry

Checkr has built an AI-backed process to handle background checks. By automating the processing of digital records, Checkr has created a highly scalable business, which can lower the cost of verification on the gig economy.

Checkr is a background check company that enables firms to make easier hiring decisions. They offer an AI-powered service that makes background checks on potential employees faster, more accurate, and lower risk. To date, the company has raised over $160 million in funding, and has been used by thousands of companies to perform background checks on over 42 million potential employees.[1]

Checkr has been able to able to take advantage of the digitization of individual and regulatory information to make background checks more efficient. By automating the processing of digital records, Checkr has created a highly scalable business, which can help lower the cost of verification on the gig economy.

A primer to the Background Check Industry

Background checks have two main purposes[2]:

- To validate information provided by a candidate through the interview process.

- To safeguard the company from people who might be potentially dangerous to others.

This is a large and growing market: In 2016, the market for background check services was $4 Billion dollars. According to the National Association of Professional Background Screeners (NAPBS), 72% of employers rely on background checks.

While digital access to private and public information on individuals is becoming more accessible, one of the bottlenecks in the traditional background check process is that verification of information requires a human agent. In this industry, there are compliance and regulatory issues that make this process more complex. Background checks are subject to federal (Fair Credit Reporting Act and U.S. Equal Employment Opportunity Commission), state, and sometimes local laws intended to protect consumer rights, reduce discrimination, and avoid collecting obsolete or inaccurate information.

Historically, in the industry, once arrest records, court documents, and other files are pulled, someone has to sift through the information to suss out what someone was arrested for, whether they were charged, and whether they were convicted. Because laws vary across geography, what’s described as felony in one place might be treated differently elsewhere.[3]

Automated Processing of Digital Records

Checkr attempts to streamline the process by pulling as much information as it can automatically and feeding it into a machine learning system. Documents gathered in-person by contractors are likewise fed into its system. Checkr also allows for more fine-tuned information about candidates – for example, the technology can discern the type and severity of a criminal charge. The result is a system the founders say can summarize disparate documents and identify convictions more quickly than any human. [4]

Highly Scalable

Legacy background checks usually require some evaluation from a human agent. Thus, the number of human agents who are trained to evaluate each check will be a bottleneck constraint and there is an associated marginal cost for each evaluation. Because of this factor, the usual business model in the industry is pay-per check.

For Checkr, limiting the amount of manual data validation creates an opportunity to scale. With the set of automated Checkr tools, doing more checks has no marginal cost in most cases. Furthermore, this can open up new opportunities. While background checks are generally conducted prior to hiring, Checkr can enable employers to actually stay up-to-date on employee infractions. This has enabled Checkr to pursue other revenue models, including a subscription model.[5]

Verification Costs for the Gig Economy

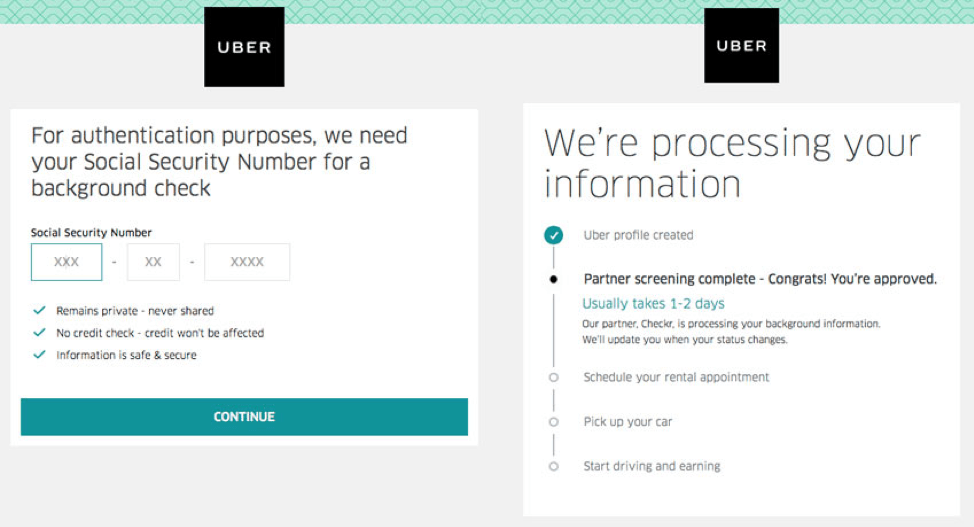

Companies like Uber, Upwork, and TaskRabbit employ many different types of skilled laborers onto their platform. On these platforms, scaling up the set of complementors can create positive network effects and help platforms compete (e.g. the more drivers Uber has in a city, the more likely customers will download and use the app). However, platform need to maintain trust and safety and ensure that the gig workers are not a liability risk. While reputation systems (like ratings & reviews on Uber) can be helpful for consumers, background checks are still often a required process.

The automation and scalable process that Checkr uses also has implications as labor becomes more mobile and employees use job platforms to find work. In these settings, decreasing the turnaround time for a background check can lower frictions for potential gig workers to join. Furthermore, being able to perform ongoing checks on driver, freelancers, and other types of gig workers can help a platform maintain compliance and trust. Integration on Checkr is simple, such that applicants can simple enter in their information and then the background check process is handled by Checkr.

Summary

Checkr has built a highly scalable and automated process to handle background checks. This process is complex given 1) compliance and regulatory requirements and 2) disparate sources of individual information. Although there are still limits to the process (e.g. county crime records are not digitized), Checkr has transformed the background check industry to address the need for speed when hiring in the gig economy.

Sources

[2] https://www.consumersadvocate.org/background-checks

[3] https://www.wired.com/story/the-startup-that-will-vet-you-for-your-next-job/

[4]https://help.zenefits.com/Hiring/Can_Zenefits_run_background_checks_on_new_hires%3F/How_does_Checkr_run_background_checks%3F/

[5] https://www.forbes.com/sites/bizcarson/2019/09/19/checkr-background-funding-round/#786e4fe95460

Great blog post, thank you for sharing. It will be interesting to see how they expand into other product offerings from the background check space. They will have a ton of interesting data to leverage here!

Very interesting post. A potentially challenge that I see to the company is issues related to user privacy. Having access to users both public and private information, the company will have to pay great care to their handling of potentially damning data.

What are your thoughts on false positives, meaning if the algorithm indicates that a potential employee lied although he or she did not? While I am sure that the algorithm will make background checks much more efficient, I am concerned that some people will have a much harder time to secure a job for no reason.

A nice example is a certain company providing automated credit ratings. There is a large Turkish population in Germany which statistically is more likely to become insolvent. Many Turks have the letter “ü” in their last name. Thus, the machine learning algorithm recognized that those who have an “ü” in their last name are more likely to not pay back their credit―the algorithm assigns those people a lower credit rating. However, what does this mean for all other Germans who have an “ü” in their last name, such as your class mate?

Thank you for sharing this post, Tommy – I think it’s super fascinating! Care.com is one such business that could have (and still) truly benefit from the value Checkr provides. Care.com which connects caregivers with those in need of their services came under fire earlier this year when WSJ revealed that some of its caregivers and babysitters were either not licensed or maintained criminal records including molestation and other offenses. In MHC, we’ve also been discussing how AI is transforming the overall talent management chain, from recruiting to performance management, so it’s great to understand how it can also be leveraged in background checks.