Building a Connected Ecosystem for Physical Operations

A quick primer on how a fleet-management software company used several sources of data to establish itself as a key system of record in the logistics industry

Trucking & logistics, as well as the broader physical operations economy offers us trillions of data points that have historically been offline or unused. There is tremendous value in knowing that a machine is vibrating much faster than it should, a car is about to break down, a pharmaceutical labeling device is mislabeling or that a driver is driving unsafely.

Samsara is a connected device platform (primarily operating in fleet management software) that offers vehicle gateways, cameras, and asset management devices to provide several data points that can be utilized for hundreds of use cases such as those listed above. For this essay, I’ll focus only on the vehicle gateway, the equivalent of a ‘motherboard’ of a car, that plugs into trucks, measures several data points (odometer reading, fuel level, braking pressures, etc.) and transmits data to the cloud using connectivity provided by a SIM card in the device, and the cameras (both inward and outward facing that provide live feeds). Built primarily to provide information on when a car is being driven so that trucking drivers could comply with the “Electronic Logging Device” mandate, the company understood that they had several data points that could enable freight management, vehicle assignments, score driver behavior, tell companies when to stop a vehicle on road side, or use braking pressure to dictate when there was ‘harsh braking’ to see whether drivers were being safe.

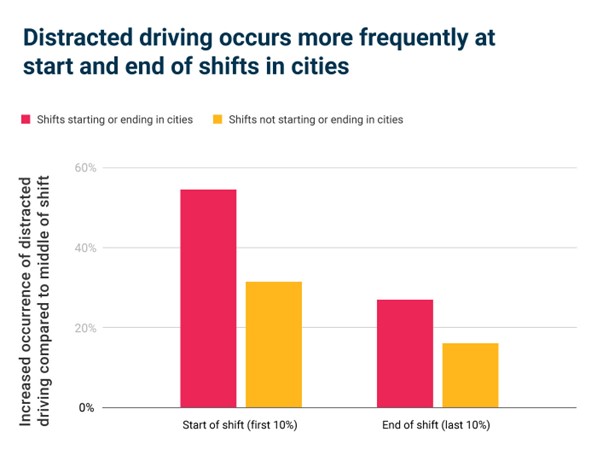

A particular example of the company using its data for a product enhancement was its driver coaching feature – using harsh braking data, as well as images of what was happening inside and outside the car (machine learning was used to train the platform to identify things such as obstacles outside the car i.e. a kid crossing the road, or inside i.e. a driver eating a burger with both hands off the wheel). By combining several sources of data, Samsara was able to create a baseline of what was considered ‘safe driving’ across its customer base (24,000+ customers with millions of vehicles, i.e. billions of data points per day) and use that baseline to create driver safety reports for companies, as well as coach drivers directly through speakers in cameras (so if a driver was about to hit a kid in 10 seconds and not seeing this was bound to happen, Samsara’s technology would prompt the driver to brake harshly, etc.). Samsara was also able to report on when drivers were most likely to be at risk of dangerous driving (see example below from their blog post on when distracted driving usually happens – more risk at starts and ends of shift in cities).

The other incredible application that location related data points became useful for was trucking load-board related work; while customers often used other pieces of software outside of Samsara, accurate fuel readings and integrations with other software providers allowed Samsara to offer companies the ability to decide the most efficient vehicle to send for deliveries etc.

From an investment perspective, the most amount of work that was required was in creating the base level of infrastructure to support such large data creation; building such a massive ‘system of records’ involved spending millions of dollars on hardware R&D and coming up with elegant, simple, easily installable devices that can be planted anywhere from a trucking fleet to school buses or even inside factories, as well as constant negotiations with telecom carriers on rates for data usage that helped the business achieve positive unit economics. A strong fundamental infrastructure layer is what has helped Samsara create several use cases / applications “systems of engagement” on top of this record layer.

The biggest challenge I foresee for Samsara is its broader exposure to the trucking economy – as fuel prices rise or we enter a recessionary environment, the company will need to diversify its customer base; it’s safety / camera products are applicable to factories, and its industrial solutions can be used on the manufacturing floor, but a significant amount of customer concentration may create exposure from both a data creation and a revenue perspective.

I really enjoyed learning about Samsara. I had never hear of the vehicle gateway or what it does in a car and I find it fascinating that this piece of equipment can measure and collect data, and then transmit it to the cloud through the SIM card and cameras. In my opinion, the fact that Samsara is able to leverage this data to create a baseline for safe driving and offer coaching to prevent driving related accidents is extremely impressive and valuable.

I love that Samsara has become an IoT success story after years of industry hype about the technology innovation. I think they made a great call in becoming a fleet-management software platform versus being a sensors company, since they are able to create and capture a lot more value from the data insights, as you shared about driver coaching and accident prevention. However, I also wonder if their key reliance in transportation and logistics may become a challenge, not only short term in a recessionary environment, but also longer term with autonomous vehicles initiatives for the trucking industry.

Fascinating post! Also in some sense, relates back partially to our DeepMap case wherein, an asset, in this case, a global AI model for object detection, is being built through customer fleet operations. It is also very interesting how they have engaged a key stakeholder, i.e., the driver, to capture value from the data collected and close the loop by guiding fleet operators’ decision-making not just based on vehicle capacities, but also on individualized driver capacities/behaviors.