Betterment – Investing automated for masses

How Robo-advisors like Betterment are democratizing wealth management for the masses at fraction of cost.

Over the last decade, Robo-advisor companies like Betterment and Wealthfront have been increasingly disrupting the trillion-dollar traditional investment advisor market. While earlier, investment advisors were available exclusively to high net worth individuals due to requirements of high minimum balance ($250K+), Betterment/Wealthfront has democratized the access to wealth management. With no minimum balance requirement and very low fees (~0.25% vs 2-3% charged by investment manager), they have increasingly gained share and have built-up $10B+ of AUM in a short period of time.

The way companies like Betterment create value is by taking the expensive middleman (human wealth managers) out and replacing the investment decisions by algorithms. They have built systems around ascertaining a user’s risk profile and then directing their money appropriately in low-cost ETFs and index funds, providing optimal returns at every level of risk. Increasingly they have added services like automated rebalancing of the portfolio, tax-loss harvesting etc. to differentiate their offering and add more value to their customers. By making this entire process extremely streamlined, transparent and affordable, they have been successful in attracting users across all age groups and not just the tech savvy millennials (~30% of their assets is from people above 50 years old).

Betterment and others claim that they help generate ~2.9% higher returns than a typical DIY investor and they have been very disciplined about capturing value that they create. They typically charge a flat fee of 0.25% on the amount invested through them on top of the low fees that ETFs charge (~0.10%). The low and transparent fee is what attracts customers to opt for a Robo-advisor. Given they are only capturing ~10% of the additional value that they are creating for their customers (0.25% of the 2.9% additional returns), I can see the fees going higher as they start showing better results than the traditional retail investing industry. With more sophisticated systems, they also have the potential to circumvent the ETFs and buy the underlying stocks/assets directly and save the ~0.10% fees that they have to pay the ETFs today.

Their entire operating model is designed to create and capture the value for their customers. In spite of being an investment platform, they are primarily a tech company with software engineers and data scientists working to build sophisticated systems and investing models. They also claim to have experienced investors on the team to decide the broad investing strategy for every risk level. Many of their services like rebalancing of portfolios, tax-loss harvesting etc. requires more data analytics then investing acumen and that is exactly how their team is structured. Also, a big component of their operating model is transparency and promoting “good behavior” amongst their customers which they achieve by building the right UI/UX on their apps/websites.

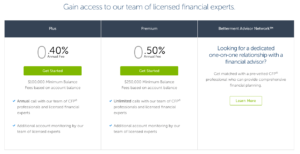

Over time, Betterment has evolved its offering from tiered pricing to flat fees. Very recently they have launched a higher priced product (0.40-0.50%) which gives customers access to a human financial advisor. The fees are still very low compared to traditional advisors that charge anywhere between 2-3%. This hybrid approach of algorithmic automation with a human touch seems to be an add-on service to attract customers who are more familiar with the traditional form of investing. It will be interesting to observe on how the traditional investment industry would respond when the Robo-advisors start going after their core segment of customers at a fraction of the cost.

I did not know about Betterment and Wealthfront and thought human oriented investment management companies such as Vanguard are the only available investment platform with relatively cheap cost. For the risk averse investor, including myself, index like assets with low cost are really attractive and I have no doubt that these disruptive companies increase their AUM.

I never heard such companies available in Japan and hope they will expand their regional coverage to east Asia soon.