AspireIQ: succeeding in the influencer marketing industry

Influencer marketing is a form of social media, where “influencers” (from celebrities to normal people) endorse specific products or brands. In the last few years, this industry grew from $1.7 billion in 2016 to $6.5 billion in 2019. And as more advertisers look for influencers to support their products, new influencer marketing platforms were built.

AspirelQ introduction, user groups and value creation

AspireIQ is series-A (about $10m raised so far) influencer marketing platform, founded in San Francisco in 2013, that connects three main customer groups.

First, advertisers who have marketing budgets and look for influencers to amplify their advertising reach. In this, AspirelQ helps advertisers by both reducing search and transaction costs i.e. providing access to multiple influencers without the need to vet them or work through contract details and, most importantly, monitoring the effectiveness of their campaigns, with social data analytics (e.g. impressions, clicks, engagement, social sentiment, reach). Second, influencers who are part of a pre-vetted database. Similarly to advertisers, AspirelQ helps in reducing search and transaction costs by saving the time needed to develop relationships with brands, sign contract and collect payments. Lastly, verification companies leverage technology to detect potential fraudulent traffic (e.g. fake influencer followers and engagement), acting as an independent 3rd party that builds trust in the ecosystem (advertisers are more confident that their investments reach real people; influencers have no incentives to generate invalid traffic, as they may be disqualified). Both the analytics capabilities given to advertisers and presence of 3rd party verification companies are important benefits for advertisers that help reduce disintermediation risk and hold all parties engaged through the official channels.

AspireIQ displays strong cross-side network effects that resulted in an exponential growth of the platform. Specifically, the more influencers join the platform, the more incentive there is for advertisers to join and access multiple influencers in one place. And the more advertisers join the platform, the more budgets are made available and so the more influencers and verification companies have benefits in joining. At the same time, the more verification companies join, the higher the trust in the system and the more advertisers join. On the other hand, the platform might display also some negative same-side network effects as the more influencers join the platform, the more competition for advertisers budgets there is among them – influencers might hence prefer platforms with lower number of influencers.

Value capture and salability

AspireIQ monetizes by charging two user groups. The company has a SaaS subscription model for advertisers (charging them a fixed monthly fee to use the platform) and charges a percentage of the commission to the influencers (variable amount, based on total budget received) on top. Verification companies are not charged by AspireIQ but are compensated by advertisers based on the number of impressions the influencer posts or videos receive. The chosen monetization strategy worked well for AspireIQ, letting the company scale quickly and triple its revenues in 2018, as they started working with 300+ advertisers including HelloFresh, Samsung and Pandora.

Competitive landscape and sustainability

Both today and in the long term though, there are several challenges ahead, as the market is for now very fragmented, with different factors driving this and putting sustainability in the long term at risk. In fact, Forrester, a well-known research company that evaluates marketing technologies to support advertisers in their choices, identified 11 relevant players in this competitive environment – Ahalogy, AspireIQ, Collective Bias, Influential, IZEA, Klear, Launchmetrics, Linqia, Mavrck, Octoly, and Traackr.

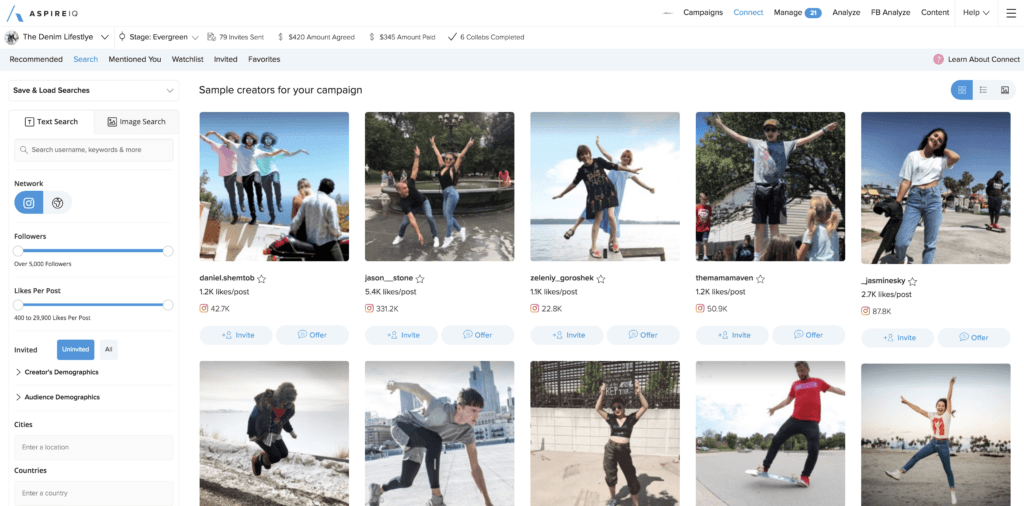

The fragmentation might be, among other resasons, due to relatively low multi-homing costs, since both advertisers and influencers tend to register to and leverage multiple platforms (advertisers can simply ask their marketing agencies to share their briefs across multiple platforms; influencers can relatively easily create and upload their profiles to multiple platforms). The only party with high multi-homing cost are verification companies that must integrate with each platform individually. Differentiation and entry barriers are quite low too, as analytics capabilities are relatively simple to build, since the source of (non-exclusive) data are the major platforms where influencers stream their content (i.e. YouTube, Facebook, Instagram, Pinterest, Snapchat, TikTok). The only capabilities that can set platforms aside are integrations with 3rd party verification companies (that are harder to execute due to integration costs) and functionality to “recommend” the best influencers to advertisers (but the performance of recommendation algorithms is at this stage still very subjective). On this, AspireIQ, like many other platforms, has an AI algorithm that helps advertisers share patterns (e.g. on images) and find matches with what specific influencers may have created in the past.

Low multi-homing costs, low ability to differentiate and low entry barriers imply that the influencer platform market might not be a winner-takes-all market and hence the long-term sustainability of AspireIQ is unclear. The significant market competition might eventually drive margins down. AspireIQ should focus on growing multihoming cost (i.e. by requesting influencers to develop richer profiles or changing their monetization model to subscription) or developing opportunities to differentiate and increase entry barriers (i.e. investing heavily into developing proprietary AI recommendation algorithms to achieve product superiority) in order to grow its position in this industry in a sustainable way.

Sources:

- https://influencermarketinghub.com/influencer-marketing-2019-benchmark-report/

- https://www.crunchbase.com/organization/aspireiq

- https://www.stedavies.com/influencer-marketing-platforms/

- https://boards.greenhouse.io/aspireiq

- https://www.forrester.com/report/The+Forrester+New+Wave+Influencer+Marketing+Solutions+Q4+2018/-/E-RES142773?objectid=RES142773

- https://www.aspireiq.com/