Ambarella: An ‘Under-The-Radar’ Winner In The Age Of Digital Video

Digital video creation and consumption has exploded over the last few years and is expected to continue expanding over the next decade. One company which has successfully leveraged this growth in digital video but remained relatively under-the-radar is the semi-conductor firm, Ambarella. The company has been able to 'win' in this environment of digital video through a combination of superior video processing technology, relevant product offerings and relevant market timing.

Context: Digital video creation and consumption has exploded over the last few years and is expected to continue expanding over the next decade. Some of the companies that come to mind when you think of this digital video are GoPro, YouTube, Netflix, HBO, NBC among others. However, not many consumers are aware about Ambarella – a semiconductor company, which has been extremely successful in leveraging this trend in digital video.

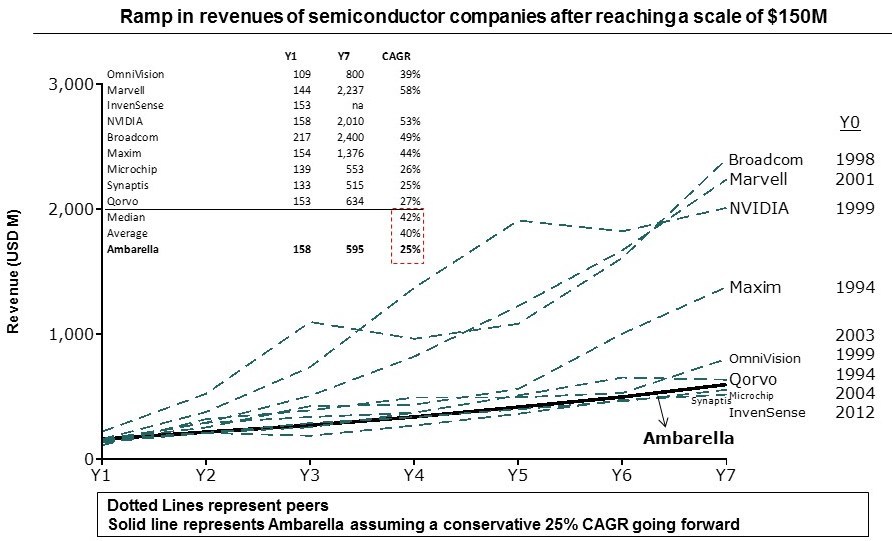

Company: Ambarella is a leading developer of system on a chip (SOC) for HD / Ultra-HD video capture, sharing and display. Their proprietary video processing architecture enables high quality performance across different environements, video compression and low power usage. This superior technology in the niche video processing products has helped the company grow rapidly delivering over 30% CAGR over the last 3 years to reach $220Mn in FY15 (Jan-2015). There is still significant room for growth driven by the underlying growth in digital video. Exhibit 1 shows growth ramp of semi-conductor companies from the time they reach $150Mn. The company’s market cap increased from $200Mn when listed in 2012 to a high of $4Bn in Jul-2015.

Customer Segments: The company’s video processing capabilities present a wide range of applications where low power usage, high quality video and small form factor are key needs. The company currently serves 4 key segments – Cameras for Sports, IP Security Cameras; Automotive & Infrastruture – all of which are expected to witness rapid growth.

Cameras for Sports is mainly GoPro, the leading sports camera. GoPro captures high quality video which needs to be compressed and stored on its internal memory. The captured video needs to be compressed to a small size in order to save on the small internal memory (to keep with the small form-factor) and also the battery needs to be low to be able to have an extended battery life for a small battery. Ambarella’s chips deliver a product for this exact need.

IP Security Camera is the digital version of the prevalent analog CCTV cameras. Because of the benefits of IP security cameras, there is shift from CCTV to digital for new purchases with majority of new installation being IP based. Additionally, there is a underlying migration from CCTV to IP. The IP Cameras have a need for high compression (because of storage and bandwidth constraints) and an ability to operate in different environment conditions (eg low light) –both of which are Ambarella’s products core offering.

Automotive cameras installed in cars to capture video in cars – a trend in Russia and other Asian countries. Ambarella’s chips can process videos in these fast moving environments and where there is a need for wide-angle views.

Infrastruture provides encoding capabilities to broadcasters to compress and transmit high quality HD data. As video transmission moves towards Ultra-HD, compression needs further increase because of the higher data and lower power needs, making Ambarella’s products even more relevant for broadcasters.

Value Creation & Capture: Ambarella has been extremely successful in creating value for their customers. Their video processing technologies have been able to achieve

- superior video compression which enables storing high quality videos using lesser memory and transmit videos with lower bandwidth requirements

- reduce power needs leading to extended battery life

- ability to work in different environments making it relevant for video capture in fast moving environments or in places with limited control of surrounding conditions like lighting etc

Because of this value they create, Ambarella Chips are mission critical for their customers, who in-turn need them to deliver value to the end consumer.

Ambarella captures value by selling the Chips to the above discussed segments. There is limited competition for GoPro in their video processing chips. Players like Qualcomm, Nvidia find the market still relatively small for them to focus on and the smaller players are behind in technology and compete mostly in the lower end of the market but not directly with Ambarella. This gives them the ability to capture value and operates at a healthy operating margin of 28% (FY15 reported Adj EBITDA%). While margins are high, the pricing of Ambarella Chips is not very high when compared the price of the final product the customer sells (eg. GoPro retails at $500 while Ambarella chip costs about $20 for GoPro). This enables Ambarella to continue capturing the value before any major push-back from their customers.

Summary: Ambarella has successfully been able to win in the first stage of digital video evolution due to their superior technology and relevant product offerings. The company is extremely well positioned to benefit from the rapid growth anticipated in digital video. However, as the space becomes more interesting to the large players like Qualcomm, it is crucial to see how Ambarella reacts to a direct competition from these large players.

EXHIBIT 1: Ramp in semi-conductor revenues (Actuals);

Ambarella Ramp assuming conservative 25% growth

I spent this past summer interning with Google, specifically with YouTube. Hence, video technology was a topic heavily discussed, so I found your post highly relevant and interesting. In giving advice to content creators to help them grow their YouTube audience, one of the most tangible recommendations regarded video quality. However, many creators often cited the limitations imposed by high technology costs. Lower costs inputs would allow for new market disruption, as there is currently a large segment of the population that is excluded from high quality video production.

I question whether Ambarella has truly been successful. If a company has flown “under the radar,” then can it actually be considered a digital winner? A key aspect of value capture is from marketing. Ambarella has clearly been successful in creating value through its development of a sophisticated product. Now, the company must focus on reaching a larger audience to maximize value capture.

Jennifer, thank you for sharing your thoughts on the post. To your point on video quality, I can imagine how it is one of the most tangible recommendations that YouTube gives their content creators. Though, I am a bit surprised that content creators are still having trouble in creating high quality videos. I remember reading about a movie maker who had shot a movie using a GoPro and similarly a lot of other short-film makers who have used the GoPro to shoot high quality videos. I would assume that the prevalence of GoPro is not high – mainly due to a lack of communication from GoPro about the strengths of their product. This should change hopefully change soon, as the company faces obstacles for growth or from a word of mouth from the existing customer base. The non-video costs could also be costs associated with content creation. I am not sure where in the evolution they are vs. the video processing technology that has come a long way over the past few years.

On the other point around whether the company has been truly successful, I used the phrase ‘under the radar’ more from the perspective of the end customer who, for example, might be using a GoPro but could likely not know about Ambarella. Again, like I had mentioned in my closing statement, it will be interesting to see how Ambarella reacts to the entry of someone like a Qualcomm wants to get aggressive in this space and how they sustain their competitive advantage.

Given the B2B nature of Ambarella where the SOCs are sold to camera makers or broadcasters, the need for high marketing is probably not an immediate need for the company which has enough white space for growth. I thought they were doing the right thing there by focusing on the R&D spend which leads to better technology which the relatively experienced business customer can appreciate inspite of a lower spend on marketing.

Thanks again for your thoughts!