Allstate Drivewise: Keeping our Roads Safer

Historically, car insurance companies priced premiums based on factors such as what type of car you drive, your past driving history, age, gender and where you live. During the past 5-10 years, insurance companies have been changing the way they underwrite by using current driving behavior data rather than past or demographic data. Allstate was one of the first auto insurance agencies to offer telematics usage-based insurance policies.

Overview

Historically, car insurance companies priced premiums based on factors such as what type of car you drive, your past driving history, age, gender and where you live. This method benefits or punishes people for simple things that they often have no control over. Some also provide safe driving bonuses to drivers who file no claims within a certain amount of time. These traditional methods are backwards looking and make a strong assumption that past behavior is predictive of future behavior which often is not true. They are static in that they don’t change as your behavior changes.

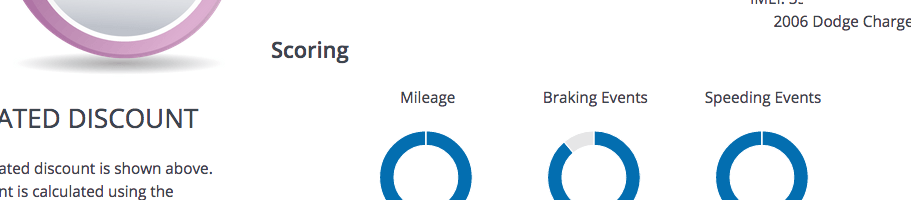

During the past 5-10 years, insurance companies have been changing the way they underwrite by using current driving behavior data rather than past or demographic data. Allstate was one of the first auto insurance agencies to offer telematics usage-based insurance policies. Its product, Drivewise, is a telematics device that plugs into your car and tracks mileage, how hard you’re breaking, how fast you’re accelerating and how often you drive at night. It released Drivewise in 2010 as a plugin device and later released a mobile app in 2014. Today, many auto insurance agencies have followed suite such as Progressive with Snapshot and Liberty Mutual with Onboard Advisor though many are still stuck in traditional underwriting.

Value Creation and Capture

For all drivers, there is value in simply knowing that metrics are being tracked. The device can even notify them when they are performing risky behaviors. They become more aware of their driving and start driving more safely leading to fewer accidents. Additionally, drivers who already exhibited safe habits but happen to fall in a category with high premiums (i.e., teenage boys), can save on the cost of insurance by proving their safe driving habits.

Allstate also captures value in many ways. First, the type of people that will sign up for this plan are naturally safer drivers. Safe drivers get in fewer accidents and therefore file less claims which is beneficial to Allstate’s bottom line. Drivers who use the device will also drive more safely since they know they’re being tracked which leads to a further reduction in accidents and claims. Additionally, this real time data they are collecting is very valuable in refining their pricing model for other policies.

Value is also created and captured by the world as a whole by having safer roads. As all the safe drivers become attracted to products like Drivewise, non-telematics product will become increasingly more expensive as they will only attract the worst drivers. Those bad drivers will no longer be able to afford the product because they are no longer subsidized by safe drivers and ideally they will start to change their behavior and become safer drivers.

Challenges

One of the major challenges that Allstate and other telematics products will face is proving that the real time data they are tracking is in fact able to predict the likelihood of accidents. Just because someone always breaks hard, are they really more likely to get in an accident? Is it correlation or causality? There are also privacy concerns given that the device captures exactly where a person is driving all the time. Consumers will also now have a harder time choosing between plans as the price is not simply calculated upfront making marketing an even more important function.

Opportunities for the Future

Getting drivers to download Allstate’s mobile app opens up a window of future opportunities for them to expand services. For example, they can offer easy payment options through the app, the ability to quickly add on additional policies or drivers, and the ability to send weekly or monthly driving reports. This makes their product much stickier.

Sources:

- https://www.nerdwallet.com/blog/insurance/comparing-drivewise-snapshot-usage-based-insurance/

- https://www.allstate.com/drive-wise.aspx

Interesting post. One main question stands out for me: Is this technology mandated by insurance companies? It would seem that if not, offering this technology would only reduce profitability of an insurance company as the only people that would adopt this product are those that are currently overpaying premiums based on their risk demographics.

Great post! I find this such an interesting use of analytics and insurance. This has also spread to health insurance – I know Oscar and other health insurance companies have their patients wearing FitBits to track that data. I totally agree with you that the predictive nature of these products is hard – in aggregate, you may be able to see if someone is more likely to have a health condition or for car insurance, get into an accident, but there also may be other external factors that these analytics aren’t taking into consideration. And do you get penalized just for being likely to have an accident or a health condition even if it doesn’t happen?

I agree that this use of analytics is beneficial for Allstate, but I have a broader concern with the business – what happens to auto insurance when autonomy takes over? This is not a short-term problem, but becomes very real when human drivers are relegated to closed circuits and daily driving is 100% autonomous. To borrow from BSSE, this sustaining innovation will only last until autonomy – the great disruptor – comes and shakes up the market.

Great post! I think the current practice makes a lot of sense – keeping drivers safer seems like a super valuable accomplishment! But I worry with these sorts of procedures if it’s a slippery slope to having everything we do be tracked. What’s the right tradeoff between safety and privacy?

Same question as above on the adverse selection of customer adoption. It would be interesting to see what steps Allstate takes to drive people other than those that overpaying based on demographic data to adopt this product. Maybe an easier route is to preinstall this device in all vehicles but in that case are the car manufacturers or the insurance companies capturing value?