Airbnb: Reinventing hospitality with network effects

In 2008 Airbnb’s founders were having difficulty raising funds for their new idea and were turned down by many Silicon Valley investors when trying to raise a mere $150,000. No doubt part of investor skepticism revolved around the difficulty inherent in two-sided marketplaces and businesses that rely on indirect network effects for success. So what is the value of Airbnb’s indirect network effects and how did they scale the business? And now that Airbnb has reached a large scale, how has the traditional hotel industry responded?

In 2008 Airbnb’s founders were having difficulty raising funds for their new idea and were turned down by many Silicon Valley investors when trying to raise a mere $150,000. No doubt part of investor skepticism revolved around the difficulty inherent in two-sided marketplaces and businesses that rely on indirect network effects for success. So what is the value of Airbnb’s indirect network effects and how did they scale the business? And now that Airbnb has reached a large scale, how has the traditional hotel industry responded?

The value model

The Airbnb business model is relatively simple: it allows homeowners to monetize unused space and provides trustworthy, unique, and often price-competitive housing alternatives to renters. The business is a classic example of indirect network effects. Value is created for homeowners when there is a large enough population of potential renters on Airbnb to give the homeowner access to a consistent flow of travelers visiting the local area. Similarly, value is created for renters only when there is a sufficient number of homeowners on the site to provide coverage of many different cities one might travel to and provide several options in that city. When scale is reached on both sides of the platform, both homeowners and renters are able to capture value via a match between accommodation availability and the renter’s desired time/location/capacity. The value of the network grows as more renters and more homeowners join the platform.

Growing the network

So how did Airbnb do it? Well, for several years the founders struggled, but eventually found a clever way to attract both property owners and renters. The founders knew that Craigslist was a large competitor that attracted the same target demographic (someone looking for a non-traditional housing experience). So, to tap into Craigslist’s scale, Airbnb discovered a way to essentially allow owners to “multi-home” their properties to list both on Airbnb and on Craigslist. Not only did this lower the barrier for a property owner to list on Airbnb, but Airbnb also received a lot of attention from renters because the properties tended to be nicer and have higher quality images than a traditional Craigslist posting. This strategy allowed Airbnb to reach a large number of renters – those who were searching for housing on Craigslist’s website – and a large number of property owners at once. Airbnb also leveraged Facebook’s social network to build its renter base. They tapped into Facebook Connect, which, when enabled, allowed renters to see friends who had stayed at a homeowner’s home and were friends with a homeowner. It also allowed renters to search for properties by more granular characteristics, such as undergraduate institution. These measures helped to foster a sense of trust, assuaging concerns and making potential renters more likely to use Airbnb.

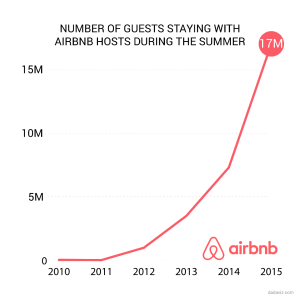

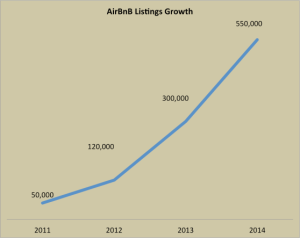

The two charts below provide an example of how both number of guests and number of listings have grown in similar patterns over the past 5 years, demonstrating the value of indirect network effects. In 5 years, the number of individuals staying in an Airbnb has grown from essentially zero to 15+ million people. Demonstrating a similar trend, Airbnb listings have grown from 50,000 to 550,000 from 2011-2014. No doubt the growth in users spurred more renters to list properties, and the increase in property options drove more users to join Airbnb.

Industry response

Airbnb is a clear disrupter in the hospitality industry, and hotels and legal professionals alike are taking a keen interest in the company’s operations. For now, hotels have largely responded through legal channels, and regulators have differing opinions on how to treat and tax the company. Airbnb currently is not subject to the same hospitality taxes and regulations that hotel are; however, Airbnb has surpassed many of these large hotel chains in size…cue the tension. As the legal battles continue, hotels will be looking for ways to further differentiate their services from those of Airbnb.

Source: growthhakers, forbes, businessinsider

Thank you for the post, Elizabeth! It is interesting to note how Airbnb went about building their network to scale it to such mammoth levels. I am sure there is a lot more growth left in the business and Airbnb seems to be making the efforts to realize this potential. In addition to the indirect network effects that you rightly pointed out, I wanted to add that there is a small component of direct network effects. As more users are on the platform the quality of the ratings and reviews improve driving better usage patterns among users. In addition, what I really like about Airbnb is their ability to attract a much younger population and their positioning of Airbnb as more a lifestyle brand than a low cost / cheap brand. As these young customers grow over the next 5 to 10 years, they are an ideal target for the business travel customer base that Airbnb is trying so hard to break into. Airbnb will most likely be the first “hotel” a future generation will stay in. The traditional hotels, with their high cost models, will find it extremely difficult to compete with that.

Agree with Karthik’s point on the importance of direct network effects in this case. It’s also interesting to think about why people choose Airbnb in the first place. Is it because they want a “home-y” experience, or are the listings actually significantly cheaper than hotels (partly due to the lack of costly regulation these units are under)? I think what we’re seeing is that people appreciate the turn-down bed service and amenities of a hotel, but in many cases, a hotel room serves more as a place to sleep (because the traveler is busy doing other things during the day). It’s especially interesting to think about whether Airbnb would ever get into any type of “rewards program,” which is how many hotels are able to get users to stay with them vs. a competing hotel chain.

I have to imagine that the occupancy rates of hotels have dropped in proportion with the increased Airbnb usage. I wonder how these units will eventually be re-purposed. Will entire hotels be torn down and used for office space? Will some of them become a new form of lower income housing? Will more hotels offer longer term stay options that are cheaper than paying a month’s rent for an apartment?

Airbnb and Uber both also exhibit interesting societal implications. Due to the minimum “quality” threshold in place for cars and rental units, the people capturing the value in these cases are often people that already “have,” vs. your average taxi driver or hotel employee (who are being pushed out of the market) are more likely in the “have not” category, which is widening the gap between these two groups. Especially in tech-booming cities like San Francisco, this is leading to an increase in evictions as wealthy tech employees are much more profitable for landlords than tenants that are under rent control. It is my hope that both Airbnb and Uber make efforts to use some of their profits to combat some of these issues.

Interesting read and thoughts on it. Besides their great exploitation of direct/indirect network effects airbnb has simply a superior quality which gave them such scale. As Elizabeth pointed out, there had been similar offerings such as craigslist and also in Europe we had several multi sided platforms to offer rooms for “short term rent”. Nevertheless, Airbnb seemed to be the first one offering insurances for both parties, having a clear website with all information needed, ratings etc.

I am wondering if superior quality and the right use of network effects (including a large network) is enough to stay the dominant player over the next 15 years? The network seems to be the biggest barrier to entry, but what if Facebook or Google start to get into this market ? Facebook has a large user base, strong network effects, is connected with Airbnb anyhow and could even support the financial transactions itself. Even though it does not seem to fit their business model and strategy nowadays, it might do so in the future.