Digital health provider platforms – will Wellpepper win users?

‘Digital health’ is a trendy term that connotes a crowded marketplace of new technological tools in medical care delivery, design, and reimbursement. Direct-to-consumer digital health involves the efforts of many ventures spanning the range of telemedicine to patient navigation of care episodes via SMS or email. There are various provider-sided digital health ventures that support predictive analytics for patient risk stratification as well as standardization of ‘care pathways,’ or algorithmic approaches to various clinical conditions that are both evidence-based and expert-endorsed. Founded in 2012, wellpepper (https://www.wellpepper.com) has differentiated itself from other B2C or B2B2C digital health offerings by initiating a two-sided platform marketplace through which providers and payers can license care guidelines and pathways published by other provider systems.

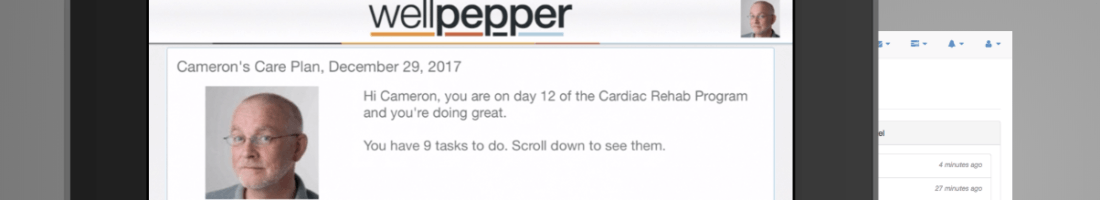

This approach is innovative insofar as it addresses the common issue faced by many digital ventures – content generation – in a novel way, neither exclusively creating proprietary content or licensing it from another third party. Rather, wellpepper allows recognized, emulated provider systems – e.g. Mayo Clinic – to post digital Care Plans for such conditions as cardiac rehabilitation to their platform (https://tinyurl.com/y3jvelbu). Content is generated directly by renowned provider systems such that other providers, payers, or patient groups can license these Care Plans for personal or institutional implementation. Mayo Clinic a first-mover toward this platform, which may attract other provider systems to generate content, fueling more third party participation of clients looking for increasingly unique or varied disease entities, treatment approaches, or partnerships.

One concern regarding this platform is that network effects will undoubtedly be weaker than in other settings where two-sided platforms have gained more traction, settings wherein members consume material goods or services toward a specific end with a well-accepte outcome. Care Plans on the wellpepper platform may be vetted by a top provider system and may improve care outcomes on average through standardization, but the likelihood of adoption depends less upon patients’ desire to become well and more upon providers drive toward standardization (a notion that is less accepted in medicine, where views on phyisician autonomy and patient idiosyncrasy often hold sway).

Should wellpepper succeed in this venture, attracting top content and licensing on both sides of its platform, it is not clear how much value they will be able to capture from such a platform strategy. Such provider systems as Mayo Clinic, the Cleveland Clinic, MD Anderson and Kaiser Permanente are already engaged in a variation of ‘care pathway’ generation by outsourcing their home sites’ clinical approach to many and varied satellite sites. Should wellpepper demand more than a miniscule margin on their platform architecture, it is likely that providers can export their care plans in another fashion with less financial friction. Moreover, it is yet to be seen how providers will approach ‘care plan’ generation for wellpepper in a way that is truly proprietary, given that the majority of care provision is based on consensus guidelines from publicly available evidence. For these reasons, wellpepper’s platform may face unique obstacles in their early days that will elucidate those conditions under which platforms generally can and cannot thrive.