RealtyMogul – Is Crowdfunding Real Estate Investment Worth It?

RealtyMogul is a real estate crowdfunding platform where investors, real estate investment sponsors, and borrowers come together to create mutually agreeable real estate investments.

Crowdsourcing in Real Estate

“We’re building upon the experience and real-time feedback of thousands of people, and that’s really exciting.” – Jiliene Helman, CEO

RealtyMogul is an online real estate crowdfunding marketplace, connecting borrowers and sponsors to capital from individual and institutional investors. Through the online platform, RealtyMogul gives borrowers access to debt capital, sponsors access to equity capital and investors a medium to browse investments, do due diligence and invest online. RealtyMogul and its community of over 80,000 online real estate investors have invested over $200 million in debt and equity real estate through the platform. It was founded in 2012 and launched in 2013 by HBS alum Jilliene Helman and Justin Hughes.

The company raised $9 million in Series A funding in 2014 and $35 million in Series B funding in July 2015. In May 2013, RealtyMogul became the first crowdfunding online platform to have funded over $200 million in debt and equity transactions. Since 2015 the platform also offers a variety of financing and investment products: Bridge Loans, Mezzanine Debt and MogulREIT.

Value Creation

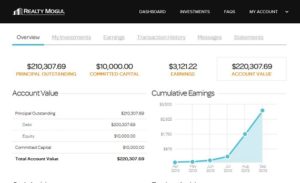

- The platform sources real estate investment opportunities, which it then presents to its members on the platform. Through this vehicle, users can invest in vetted commercial real estate properties that were previously hard to find and even more challenging to access. After browsing and screening a list of various real estate opportunities, investors can view details of an investment, sign, and purchase shares online. Following the initial transaction, customers are invited to log into the dashboard system to see how their properties are doing as frequently as they would like.[i]

- Members can diversify their portfolio of properties across the U.S. and through alternative asset classes without solely relying on the public market.

- Efficient and convenient process for investors who may not have experience in the real estate.[ii]

- Vetting Process for Investors: Realty Mogul assesses the property, the borrower or sponsor, and conducts background and criminal checks prior to offering investment opportunities. [iii]

- Vetting Process for Sponsors/Borrowers: Due diligence process before their investment opportunity is available to the platform’s accredited investors pool. Between $1 million and $10 million can be raised.[iv]

Value Capture

Individuals invest by purchasing shares in a RealtyMogul.com limited liability company LLC that in turn invests into a secondary Limited Partnership that holds title to the real property. The platform charges sponsor a commission on funds raised with a fee based on the amount. Investors are charged a 1-2% annual investor reporting and technology fee, which is based on invested capital.

Unlike other real estate crowdsourcing platforms, Realty Mogul has been more transparent with their deal flow data, even including a “statistics” section on their website. In addition, unlike other real estate crowdfunding platforms like Fundrise, the minimum investment amount is $10,000.

Benefits and Challenges

By offering a marketplace for accredited investors to pool money online, it eliminates barriers to investing in real estate for the everyday modern property buyer. Investors can now use crowdsourcing to buy shares of offices, apartments, and shopping centers.[v] Opening this asset class up through efficient and direct access to investors of all geographies, is a juicy opportunity, and there is no shortage of platforms competing for it.[vi] Furthermore, real estate crowdfunding and fintech platforms enables new opportunities for agents to work with buyers on creative financing options.[vii]

Competition is fierce and platforms are competing to become the gateway of direct real estate investment. Trends could likely track similar to the peer-to-peer industry where a few key players emerge to dominate the broad market and marketplaces are largely transactional. Additionally, the company is busy vetting and undergoing due diligence of hundreds of investment and financing opportunities before they can be listed on the platform and users are able to participate.

[i] https://tech.co/property-investing-made-easy-with-realty-mogul-2013-03

[ii] https://www.realtymogul.com/about-us/why-us

[iii] https://www.realtymogul.com/about-us/why-us

[iv] https://www.realtymogul.com/about-us/why-us

[v] https://tech.co/property-investing-made-easy-with-realty-mogul-2013-03

[vi] http://www.thecrowdcafe.com/talking-real-estate-crowdfunding-realtymogul/

[vii] https://centricdigital.com/blog/big-data-visualization/real-estates-embrace-digital-transformation/

Thanks for the post! Though RealityMogul provides a new stream of investment opportunities for consumers, I can’t help wonder the legitimacy of its projects. Why did these projects decide to crowdsource funding? Does that imply that they might be unable to secure funding through the traditional channels? In this case, are these projects with high-risk profiles taking advantage of the less sophisticated consumer investors? On the other hand, the large number of consumer investors could help diversify the high risks – this might be the exact answer to such risky projects. It would be very interesting to see how things play out in the company.