Will DocuSign push out paper-pushers during the pandemic?

COVID-19 outbreak has challenged the way many businesses are conducting their activities, including those as essential as signing. With no opportunities to sign agreements on paper physically in the era of physical distancing but still pressing needs to sign contracts such as medical consents for COVID-19 testing or patient intake forms, DocuSign has come to the rescue with its ecosystem of electronic signatures processing. However, if the company succeeds with its mission of universal use of electronic signatures as new normal, would it be able to defend its positions in the market, or would its services become commoditized or performed better by other tech giants?

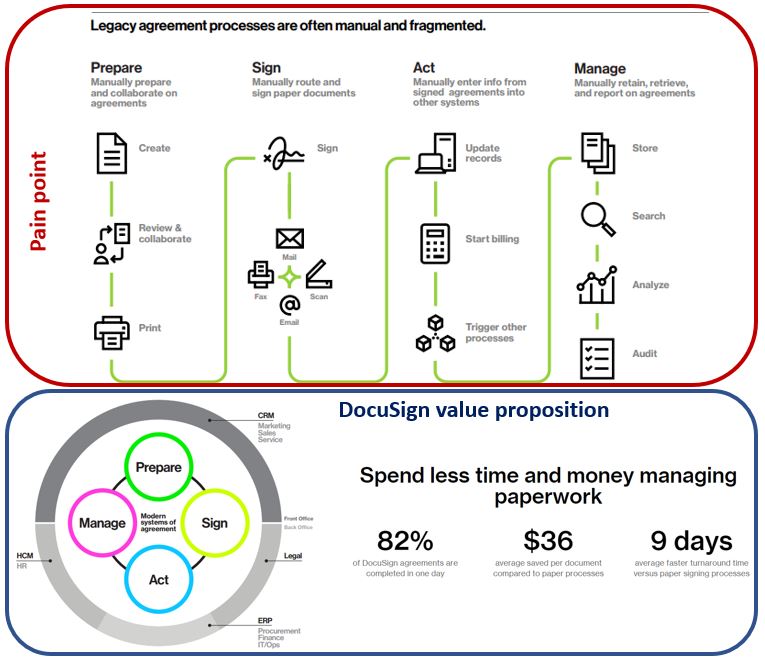

DocuSign was founded in 2003 and since then has pioneered electronic signature solutions globally to help businesses process agreements and contracts more efficiently. Agreements like sales contracts, employment offers, and NDAs remain the foundational element of almost any business, but the agreement process has seen little innovation from new technologies at hand. The traditional agreement processes follow paper medium from signing to acting on the contracts, storing, and aggregating data – all done mostly manually, with little automation, and involving multiple human errors.

DocuSign saw the opportunity to transform this process digitally through a suite of software applications encompassing agreements origination, electronic signatures, post-signature actions like payment collections, and contract data analysis. All these steps are tightly integrated with other sales and operations workflows through over 350+ prebuilt interfaces embedded in other work systems (Salesforce, SAP, Workday, etc.) and extensive use of APIs. [1] As of the end of January 2020, the company counted over 585k customers (i.e., clients paying for the services) and hundreds of millions of users (i.e., people using DocuSign for e-signatures) [2].

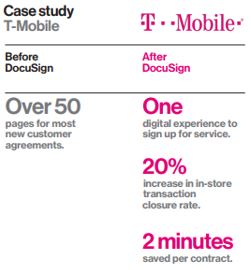

DocuSign focused early on large enterprise customers aiming to capture value through long-term subscriptions priced based on the amount of services provided and “digital envelopes” signed. Given the negligent cost of each “envelope” and massive accumulated benefits to the clients from the ease of use, DocuSign has quickly created demand and took ~60-70% market share [4]. The company has

been initially focused on the most lucrative niches such as real estate, financial services, insurance, and others (incl. mobile service contracts as exemplified by T-Mobile case study) where the added user convenience helped DocuSign’s customers to get massive ROIs. However, as the e-signature has become more widely adopted, the use cases now include even SMBs (such as Kauai nut roasters presented in the video below) willing to streamline their contract processes by leveraging DocuSign’s infrastructure. The company estimates that it currently captures just around 4% of TAM of $25 bln and growing [3].

COVID-19 lockdowns provide DocuSign with huge opportunities to increase its market penetration, given the increased number of use cases. The company is now serving hospitals and clinics to get rid of potentially contagious paper and clipboard circulation and switch to electronic signing. The most salient example of the necessity to remove physical signing being patient agreements for drive-through COVID-19 testing and advance of telemedicine services. DocuSign has also been essential for many emergency lending operations (operated through banks’ APIs), not only allowing SMBs to get loans without physical branch visits but also speeding up the process and ensuring accurate agreements data collection. Other areas of increased e-signature acceptance include government services, such as signing quarantine orders by infected people, a transition of courts’ orders and judges’ sign-offs into digital formats, remote hiring and onboarding procedures, and many more. [5]

Below, I analyze whether the company will be able to solidify its leadership positions as a true disruptor, or it would fall prey to the curse of a trailblazer and eventually lose the competition in sustaining innovations to established incumbents. Although e-signature itself has become a commodity provided not only by DocuSign but also by Adobe and the slate of other start-ups (each holding below 10% market share [4]), I believe DocuSign has been strategic in playing to its advantages and creating new moats around its business:

First, the company has been partnering with leading software providers (Salesforce, Microsoft, etc.) both to advance the adoption of DocuSign products and prevent competition from the tech giants. Many big tech corporates, such as Google, SAP, Salesforce, Visa, etc. hold equity stakes in DocuSign, and still others, like Microsoft and HP, have been early incorporators of DocuSign functions in its products through vendor agreements. [6] Apparently, that is a mutually beneficial equilibrium where big tech benefits from improved quality of their own products by utilizing best-in-class trusted e-signature, and DocuSign effectively consolidates industry efforts to increase e-signature adoption by standardizing the procedures. That allows end-customers to use a single straightforward product across all software infrastructure in a seamlessly integrated manner precisely because DocuSign is prebuilt in most of the enterprise software architecture. On top of this off-the-shelf integration, DocuSign is also actively encouraging the development of APIs for embedding DocuSign in the client’s custom apps. As of mid-2018, more than 60% of e-signatures came through APIs created by over 80k developer sandboxes [7]

Second, just as traditional physical signature followed by the elbowshake, e-signature still has to be secure, reliable, and ultimately its adoption is based on the users’ trust. I believe this creates the network effect for DocuSign: more and more users having a successful experience with DocuSign start to trust it, and that in turn encourages more and more customers to adopt DocuSign to close sales faster and more effectively knowing that DocuSign would be widely accepted by the users. Furthermore, the current COVID-19 situation might create a proverbial “can I docusign it?” request from the user side.

Still, given the low complexity of e-signature on a standalone basis, there is a threat of software players effectively multi-homing e-signature providers due to the low cost of such integration. To address this challenge, DocuSign has been actively enhancing its products ecosystem to include services like automatic agreement preparation, payment collections, and lastly, analytical insights from the large base of contracts on the customer side. Just recently, DocuSign acquired Seal Software to leverage their AI capabilities of automatically collecting, standardizing, and analyzing the data. This may become the digital flywheel for DocuSign if it manages to capture its first-mover advantage and current tailwind from accelerated adoption. If successful, DocuSign should be able to leverage available data both to improve the quality of its algorithms (i.e., across-subjects) having superior R&D capabilities and financial resources dedicated specifically to the agreement data analysis challenge and to provide exceptional differentiated service to particular customers (i.e., within-subjects) by accumulating vast amounts of docusigned agreements and finding useful patterns within the individual customer data.

DocuSign Intelligent Insights Product Demo

We will see that COVID-19 will transform the way of doing business much faster than one could have expected, but in many cases, that would help to fight corporate inertia and open new possibilities for the customers increased productivity along the way. Just as Visa and Mastercard helped the US to transition to a largely cashless economy, DocuSign might be in the lead of another paperless revolution.

Sources:

[Exhibit 1]: based on DocuSign’s white paper https://www.docusign.com/sites/default/files/resource_event_files/DocuSign-Rise-of-Modern-Systems-of-Agreement-White-Paper.pdf

[1]: DocuSign website https://www.docusign.com/company

[2]: DocuSign Annual Report 2020 https://s22.q4cdn.com/408980645/files/doc_financials/2020/Annual/DocuSign-FY2020-Annual-Report.pdf

[3] DocuSign IPO fillings 2018, Form S-1

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001261333/2d27574a-d447-4e45-bc96-fa2edee6df8d.pdf

[4] Forbes, “DocuSign Aims To Build Upon Its $25 Billion E-Signature Opportunity”, 2019 https://www.forbes.com/sites/robertdefrancesco/2019/05/19/docusign-aims-to-build-upon-its-25-billion-e-signature-opportunity/#6fa9a4e04082; Datanyze survey https://www.datanyze.com/market-share/electronic-signatures–309/docusign-market-share

[5] DocuSign and COVID-19 https://www.docusign.com/covid-19

[6] Forbes, DocuSign This: How Keith Krach Made His Company A Verb, 2019 https://www.forbes.com/sites/andrewcave/2015/02/24/docusign-this-how-keith-krach-made-his-company-a-verb/#34315f144b93

[7] DocuSign Launches New Developer Center as API Usage Doubles https://www.docusign.com/press-releases/docusign-launches-new-developer-center-as-api-usage-doubles

This really is a great opportunity for DocuSign to differentiate itself from other players and capture value. My main concern is that for many applications, government organizations or banks require you to e-sign their documents with DocuSign and still mail in a physical copy with a hand signature at your earliest convenience. While this buys the customer a bit of time to print and go to the post office, it still defeats the ultimate purpose. Hopefully in the long run DocuSign will be able to change that norm.