(Z)estimating iBuying opportunities for Zillow

Homeowners have strong opinions on the Zillow Zestimate, but it’s hard to deny that it has created a great deal of value for buyers, sellers, renters, and landlords – but what can Zillow do to avoid a plateau as the Zestimate approaches maximum accuracy?

Zillow, a large U.S. online real estate and home information marketplace[i], is a real estate platform that, at the simplest level, facilitates connections between home buyers (landlords) and sellers (renters). Data and algorithms have played a critical role in attracting more users to the Zillow platform; the company has been praised for collecting home transaction data since early in its history, and using this data to create products of significant value to users.

One example of a value-additive, data analytics-driven product is the Zillow “Zestimate,” which is the sale (or rental) price that Zillow would estimate for the property given all public and provided information that Zillow has on the property. This information is publicly available and intended to be used as one point in decision making – whether that be a seller trying to decide whether it is worth it to list their home for sale, or a buyer trying to decide on an appropriate offer price.[ii]

The Zestimate algorithm is, at its core, informed by the sale of comparable properties. Zillow looks at the sale prices of multiple comparable properties, and tries to tease out the home value given property features ranging from the basic (e.g., neighborhood, square footage, number of bedrooms and bathrooms) to the nuanced (e.g., fireplace, stainless steel appliances, original wood floors). The resulting Zestimate is, in theory, a highly accurate estimate of the home’s true market value – and freely available to all.[iii]

The “Zestimate” is a key component of Zillow’s virtuous cycle and therefore to increasing usage

For active buyers and sellers, the resulting Zestimate is valuable because it helps inform their asking price and offers; in a sense, it forces more pricing transparency during the listing and search process, which was previously rather opaque. For homeowners contemplating a sale, the Zestimate for their own property can help them understand whether it is the right time to list a property, and the Zestimates for other properties can help them identify which pre-sale home improvements might have positive ROI (e.g., painting, refinishing floors, etc.).

Since the algorithm is fueled by comparable home transactions, it needs growing volumes of listing data to improve accuracy. In its early days, Zillow rolled out numerous incentives to encourage agents and homeowners to list on Zillow, and then used the data from those listings to improve the algorithm and produce more accurate Zestimates. As Zillow listings grew, the Zestimate median error rate fell from 13.6% in 2006 to 8.0% in 2015[iv], and eventually to 1.9% by 2020[v]. As the error rates fell, the Zestimates became more trusted and ubiquitous, thus creating standalone value that encouraged users to engage with Zillow

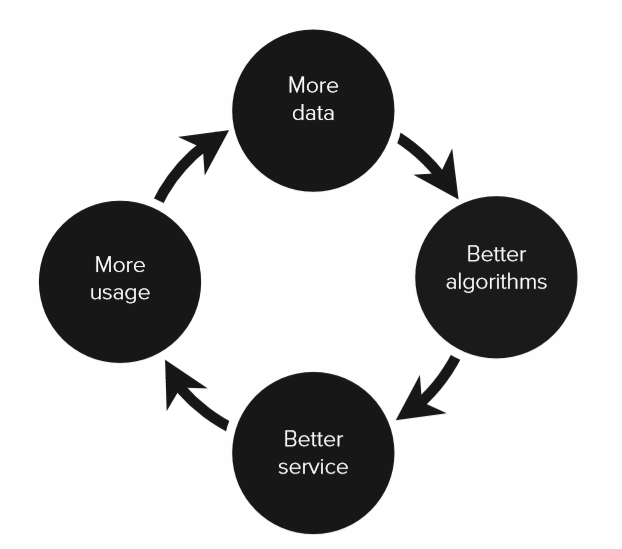

This is an example of the “AI factory’s virtuous cycle” (see below) described in Competing in the Age of AI:

More transaction data leads to improved algorithms, which generate more accurate Zestimates (a better service), which attract more users seeking pricing information.

The Zestimate creates value for all parties, but this value – and Zillow’s capture – is bound to plateau as the Zestimate becomes more accurate

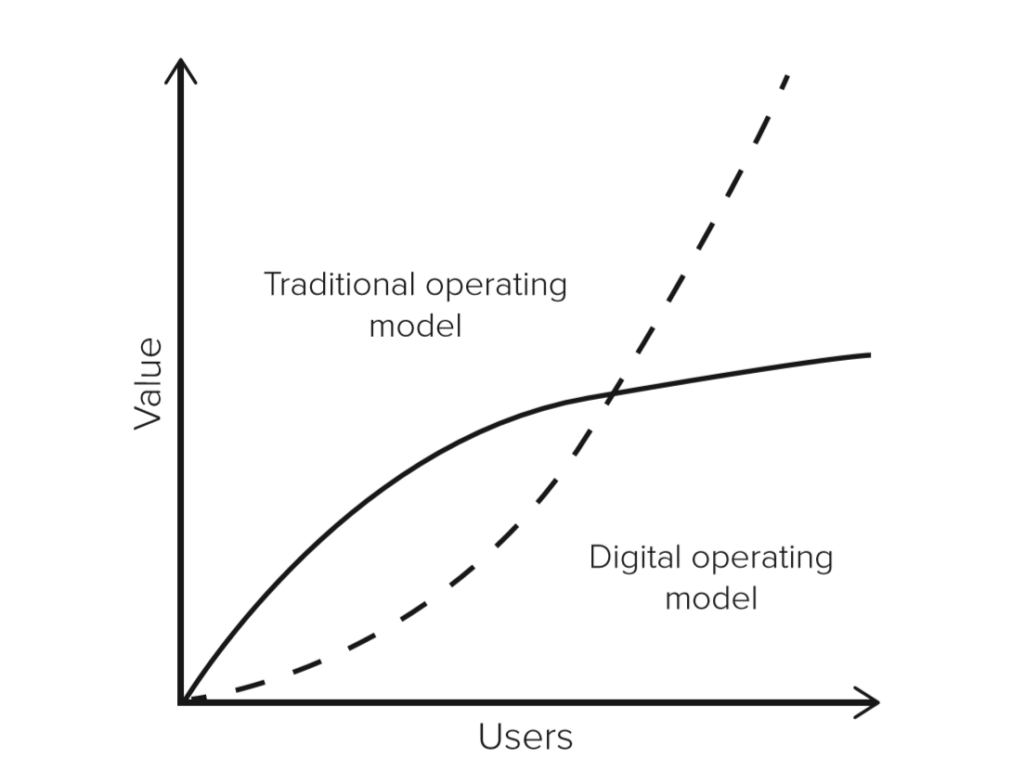

With enough usage and data, Zestimates, in theory, will reach a point where they are so good – perhaps even perfect – and any further improvement would be impossible or unprofitable. At that point, the value created by Zestimates will plateau.

One of the core observations from Competing in the Age of AI is referred to as “the collision between traditional and digital operating models” (see below), which states that a digital operating model allows a firm to avoid this value plateau:

If Zillow were to continue focusing on the Zestimate product, they would effectively be behaving like a firm with a “traditional operating model” in the sense that they are foregoing the unique scalability of a digital operating model. In order to unlock the potential for exponential value creation, it is essential that they capitalized upon their data and algorithms to find new ways to create and capture novel, incremental value that further fuels the virtuous cycle.

Zillow’s best opportunity to jump the curve and create exponential value for buyers, sellers, and themselves may lie in iBuying

iBuying, or making an instant cash offer to homeowners in exchange for receipt of a home as-is, is a growing trend in the U.S. Homeowners who accept an iBuy offer generally report that they feel that they accepted a lower price than they would have through a traditional sale process, but were willing to do so for the convenience and certainty that an iBuyer can offer.[vi]

Zillow launched Instant Offers as an experiment in iBuying; it is a relatively early experiment in a fiercely competitive space, but the Zestimate algorithm creates unique opportunities for Zillow to create value through sales and capture it through commissions and arbitrage.

Zillow has through the Zestimate algorithms , in theory, a relatively accurate picture of the home’s current (and potential) market value, which gives the homeowner peace of mind that the offer is reasonable and gives the future buyer peace of mind that the sale price is reasonable – a peace of mind is of great value in the home-buying process! Zillow is able to capture value through profit on the sale, and by using the transaction and home improvement data to improve the core Zestimate product.

[i] Zillow Group, Inc., 10-K Filing, 2019.

[ii] Zillow.com, “What is a Zestimate?”. https://www.zillow.com/zestimate/.

[iii] Ibid.

[iv] Bundrick, Hal M., “Putting Zillow’s Zestimates’ Accuracy to the Test?”. NerdWallet, 12 November 2015, https://www.nerdwallet.com/blog/mortgages/putting-zillow-zestimates-accuracy-test/.

[v] Zillow.com, “What is a Zestimate?”, https://www.zillow.com/zestimate/.

[vi] Million Acres, “What is an iBuyer? iBuying explained”. https://www.fool.com/millionacres/real-estate-market/real-estate-innovation/what-ibuyer-ibuying-explained/.

Very interesting post. I’m actually using Zillow a lot at the moment (in searching for a place to rent)!

It’s clear that “Zestimate” is a major competitive advantage for Zillow. The reduction in error rate is evidence that Zillow has done an excellent job in refining the engine over time.

However, I’m actually more concerned about the “Instant Offers” service. Am I right in saying that this cuts out traditional real estate agents? I wonder what their response would be to this move – they may start discouraging clients from listing on Zillow, as they would lose the commission on any iBuy transactions. This could start to damage the platform as real estate agents are likely the main “gatekeepers” to new listings.

Initially, I was also concerned that this service was liable to fraud – i.e., people posting fake homes to try get a payoff. But from the “Instant Offers” FAQ, it seems like the last step is an in-person home evaluation (link below). Given monetary amounts, I can’t imagine that Zillow will ever try to do an “Instant Offer” without a final human-evaluation step!

Link: https://www.zillow.com/z/offers/faq/

Hi there!

Yes, I believe you are right that this cuts out the real estate agent. That definitely creates a risk that real estate agents stop posting their other listings on Zillow in retaliation, but I wonder if Zillow feels this isn’t a concern because they are already at such a huge scale that to forego posting on Zillow would be too detrimental to the agent.

The more I think about it, I realize that Zillow’s core business, even without the Instant Offer, effectively disintemediates the real estate agent to some extent. The fact that we can now go online to find properties, message the owners, schedule a showing, etc. without help from an agent probably also frustrated the agents when it first came out – and yet, they’ve tolerated it, and even participated. So perhaps that is a sign that the value Zillow creates for the agents and brokers is sufficiently great that they’re willing to tolerate some competition – similar to the paintball gun retailer who was willing to keep working with Amazon even though they “stole” some of his suppliers.

Thanks for the interesting article. I also have a question around the implication of this on real estate agents, so I figured I’d add on to this question. In the long-term, do you think Zillow has the potential to disrupt real estate agents to the same degree that Uber/Lyft disrupted taxis?

And if so, do you think there is something that real estate agents can do today to stay competitive in the long-term?

Thank you!

Russell

Thanks for a great article! I’m also in the market for a new apartment after graduation and have spent a lot of time on Zillow recently. One of the key issues I’m curious how Zillow will tackle is the unknowns in a house that can’t be factored into the algorithm. Did the previous owner remove the appliances? DIY repairs and renovations that may not be captured in housing reports? Is there damage to the foundation / structure? Nuances in HOA agreements that might increase liability on the property? Zoning risks limiting rentals / people allowed in the residence? Tax exemptions relevant to owners not available to rental operators / businesses? Foreclosed properties usually have very little information available, but may be underpriced and disproportionately represented in the algorithm. This requires significant legal and in-person checking which significantly changes the margin and cost-structure for Zillow, potentially shifting its overall core offering.

Also, it seems that much of the input into the algorithm can’t capture the nuances of home buying and that these models are largely based on retrospective information and less forward-looking, predictive data. Furthermore, I can imagine a world where sellers game the system by artificially boosting listing prices, test various offers, etc. Will Zillow be able to filter these corrupted inputs? Even small percent error on housing can add up on thin margins. They will want to be careful to avoid a WeWork scenario.

Overall, an exciting concept, with high risk and high reward!

Interesting article! I think Zestimates were an incredibly innovative solution at the time – it’s easy to forget how difficult this information was to gather before data analytics came into the picture. I see home buying as a huge area for data analytics to improve upon. So much of the industry relies/relied on traditional selling structures (brokers, real estate agents, siloed data, etc). The data component especially was challenging, since data was sold in large “volumes” by real estate agents. Zillow really disrupted the entire process with Zestimates, so much so that real estate agents must work WITH Zillow now.

But I also see Zestimates now falling into that “traditional” model you mentioned. I think Instant Offers is a great next step, but I don’t think it’s sufficient to avoid the plateau. I’m interested to see what innovations will come next.