This post was originally published on the Digital Initiative’s classroom blogging platform as part of the 2017 RC TOM Challenge.

The supply chain of the future delivers hyper-customized products on-demand, locally sourced, and taking advantage of economies of scale. How so? Through the immense power of 3D-printing.

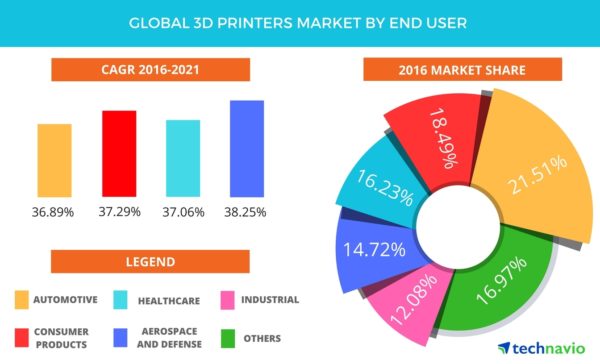

Today less than 1% of all global manufacturing output is created using 3D-printing (also known as additive manufacturing) [1], but 2/3 of US manufacturers are already using this technology in some way, from experimental prototypes to full-scale mass production [2]. It is this shift into 3D final product manufacturing that alarms the logistics providers of the world and led to UPS’ recent foray into ‘end-of-runway’ 3D-printing for its manufacturing clients. Currently UPS generates a portion of its revenue (<10%) from storing and shipping parts for manufacturers [3], primarily smaller spare parts that are critical to operations and therefore require accelerated delivery. Manufacturers have seen the opportunity here and entered this space as well; in August Mercedes Benz Truck initiated 3D-printing metal parts for older series vehicles [4]. While losing this revenue would be detrimental to UPS, it is the threat to its core logistics and delivery service that should concern UPS more, as the opportunity to localize production near end-use demand would mean a decline in global freight and air cargo volumes [5].

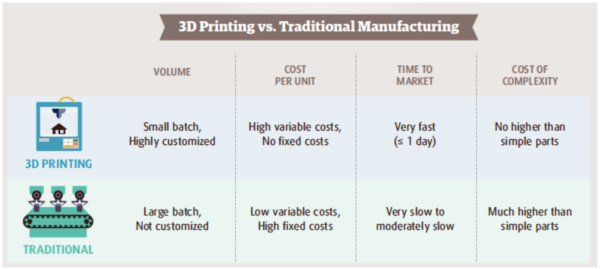

To counter this threat, UPS has partnered with SAP and Fast Radius, a 3D-printing manufacturer, to establish 3D-printing factories at UPS’ air cargo operations in Louisville, KY and Singapore [6]. Not only does this system offer UPS customers extreme lead-time reduction (UPS indicates orders can be shipped as early as same day [7]), but it also gives them access to the immense benefits of complete demand visibility through Just-in-Time production enabled by virtual warehousing. Currently manufacturers estimate demand for spare parts during initial production runs to take advantage of producing at large scale and avoid re-tooling costs. While many items move quickly, there is a long tail of parts that are rarely or never used, not only burdening the manufacturer in inventory holding costs, but also in parts obsolescence cost of having produced the item in the first place [8, 9].

Additional benefits of 3D-printing for UPS’ customers include everything from avoidance of import/export costs through in-country manufacturing, to in the long-term extreme, complete simplification of the supply chain by transforming raw materials straight to finished goods in one location by printing all component parts. 3D-printing also enables manufacturers to offer the hyper-customized products consumers increasingly demand [10], while maintaining mass manufacturing capabilities and avoiding typical re-tooling/mold costs associated with small batch production [11].

UPS’ expansion plans in this space take two paths: 1) replication of the current model in other locations worldwide, with Europe the most likely next step, potentially in their Cologne, Germany air hub [12] and 2) accumulating experience by offering consumer 3D-printing at 60+ locations around the US [13].

This is not enough. UPS’ actions in the space are not commensurate to the threat this technology poses to its business, nor is it sufficiently capitalizing on its advantage (over standalone manufacturers) to access scale in this space via aggregation. While UPS has an edge for now, as key US competitor FedEx has expressed no interest in the space and German behemoth DHL has a similarly small offering, the real threat is lurking in the periphery. Over two years ago, Amazon filed patents for truck-based 3D-printers [14], in a move that would enable not only faster shipping, but also complete product ownership from manufacturing to consumer. Amazon has the power to squeeze UPS out of this space, with a logistical prowess to rival UPS, superior automation and technological expertise [15], and the scale volume to drive itself down the experience curve to improve process time, cost and applicability of 3D-printing creating an incredibly hostile environment for any casual competitor [16].

UPS should double down in this space in two key ways:

- Predictive modelling: Through its partnership with SAP, this program identifies millions of parts currently held in inventory that are recommended for on-demand production [17], yet true cost-savings comes from not having produced these parts at all. SAP and UPS should partner with customers who do periodical re-releases/updates of similar products (e.g. auto manufacturers) to identify 3D-printing advantaged parts in advance.

- Drive volume by assuming risk/cost: As outlined above, to reach the full benefits of 3D-printing UPS needs to access learnings through increased throughput. UPS should offer a fee-for-service model where it assumes the (currently) higher costs for using 3D-printing as well as the risk associated in exchange for a customer’s manufacturing volume. As costs decline and this service becomes profitable, this should shift to a profit sharing model to further drive customer conversion.

Do you think the ‘Uberization’ of manufacturing is possible, where companies own a product design but outsource manufacturing and distribution via the UPS 3D-printing model?

What knock-on effects might this system have? E.g. design, environmental, labor-force, legal impacts?

[1] PWC, “5 Ways 3D Printing Revolutionizes Manufacturing,” http://usblogs.pwc.com/emerging-technology/5-ways-3d-printing-revolutionizes-manufacturing/

[2] PWC, “3D Printing Comes of Age,” https://www.pwc.com/us/en/industrial-products/3d-printing-comes-of-age.html

[3] Reuters, “UPS expands 3D printing to stay ahead of a threat,” Fortune, September 2016, http://fortune.com/2016/09/19/ups-expands-3d-printing/

[4] Daimler, “Premier at Mercedes Benz Trucks,” http://media.daimler.com/marsMediaSite/en/instance/ko/Premiere-at-Mercedes-Benz-Trucks-New-from-the-3D-printer-the-first-spare-part-for-trucks-made-of-metal.xhtml?oid=23666435

[5] Zen Chen, “Research On The Impact Of 3D Printing On The International Supply Chain”. Advances In Materials Science And Engineering (2016): 2.

[6] Benjamin Zhang, “UPS pact gives companies access to large-scale 3D printing and virtual warehousing,” http://www.businessinsider.com/ups-sap-fast-radius-on-demand-3d-printing-2016-11

[7] “UPS to launch on-demand 3D printing manufacturing network,” UPS press release, May 2016, https://pressroom.ups.com/pressroom/ContentDetailsViewer.page?ConceptType=PressReleases&id=1463510444185-310

[8] John Chandler Johnson, Amir Sasson, “The 3D printing order: variability, supercenters and supply chain reconfigurations”. International Journal of Physical Distribution & Logistics Management 46 (2016): 85.

[9] DHL, “3D Printing and the Future of Supply Chains,” November 2016, http://www.dhl.com/content/dam/downloads/g0/about_us/logistics_insights/dhl_trendreport_3dprinting.pdf

[10] Christopher Perry, Elizabeth Spaulding, “Making it personal: Rules for success in product customization,” Bain & Company, September 2013, http://www.bain.com/publications/articles/making-it-personal-rules-for-success-in-product-customization.aspx

[11] DHL, “3D Printing and the Future of Supply Chains,” November 2016, http://www.dhl.com/content/dam/downloads/g0/about_us/logistics_insights/dhl_trendreport_3dprinting.pdf

[12] Reuters, “UPS expands 3D printing to stay ahead of a threat,” Fortune, September 2016, http://fortune.com/2016/09/19/ups-expands-3d-printing/

[13] “UPS to launch on-demand 3D printing manufacturing network,” UPS press release, May 2016, https://pressroom.ups.com/pressroom/ContentDetailsViewer.page?ConceptType=PressReleases&id=1463510444185-310

[14] Greg Bensinger, “When drones aren’t enough, Amazon envisions trucks with 3D printers,” The Wall Street Journal, February 2015, https://blogs.wsj.com/digits/2015/02/26/when-drones-arent-enough-amazon-envisions-trucks-with-3d-printers/

[15] Nick Wingfield, “As Amazon pushes forward with robots, workers find new roles,” The New York Times, September 2017, https://www.nytimes.com/2017/09/10/technology/amazon-robots-workers.html

[16] Steven Pearlstein, “Is Amazon getting too big,” The Washington Post, July 2017, https://www.washingtonpost.com/business/is-amazon-getting-too-big/2017/07/28/ff38b9ca-722e-11e7-9eac-d56bd5568db8_story.html?utm_term=.e3d1681f5d08

[17] Rick Smith, “Announcements from UPS, SAP, HP and Fast Radius mark historic turning point for manufacturing,” Forbes, May 2016, https://www.forbes.com/sites/ricksmith/2016/05/18/announcements-from-ups-sap-hp-and-fast-radius-mark-a-historic-turning-point-for-manufacturing/#3e1f8cb079e2